IT NEWS

The fresh Resident $step one put 2025 Controls of time Viewpoint WATRBAR

- 24 Tháng Năm, 2025

- Posted by: gdperkins

- Category: Lĩnh vực CNTT

Content

Thank you for reading this post, don't forget to subscribe!Enter the taxation matter on line 51 and complete Function They-360.step 1 together with your come back. To learn more, come across Mode They-360.1-I, Tips to have Mode It-360.1. You must complete the new completed borrowing variations and you can Mode They-203-ATT together with your return. For many who used Function It-230, Region 2, you must complete the Nonresident and you can part-season citizen money fee schedule of Function They-230-We, Recommendations to have Form It-230, in order to estimate the money payment to get in online forty five.

Your property owner can charge your certain costs for example late, amenity (gymnasium, laundry), very early cancellation, online bank card processing, software, lawyer, vehicle parking, and shops fees. Depositing funds online is one of the most simpler procedures. Click here JailATM.com to begin with the process of transferring monies. Twice (2X) the newest month-to-month quantity of the entire cost of all of the lights expected.

Financial legislation ban united states out of honoring wants digital fund withdrawal or head put if the financing to suit your commission (otherwise refund) perform are from (otherwise go to) a merchant account official source outside the You.S. You may also are obligated to pay an estimated tax penalty for individuals who didn’t have sufficient withheld from the wages or didn’t create sufficient projected income tax money to your most other earnings your gained in the season. The overall contributions wil dramatically reduce your own reimburse or increase your income tax payment. You can not replace the count(s) you give once you file the return, whether or not we afterwards to change your reimburse otherwise balance. Under IRC part 1402, money away from certain employment is treated since the income of a trade or company, that is said for the federal Plan SE (Mode 1040) because the web earnings away from notice-a career.

Your own landlord must were a listing of write-offs

More resources for undisclosed international financial assets, find section 6662(j) and/or Recommendations to possess Function 8938. In the event the a product or service on your own come back is due to a tax security, there is absolutely no avoidance to own a sufficient revelation. But not, there is a decrease to possess a posture that have nice power, however, only when your relatively considered that your tax therapy are more likely than just perhaps not suitable medication. More details regarding the filing Function 8938 are in the fresh Instructions to have Form 8938.

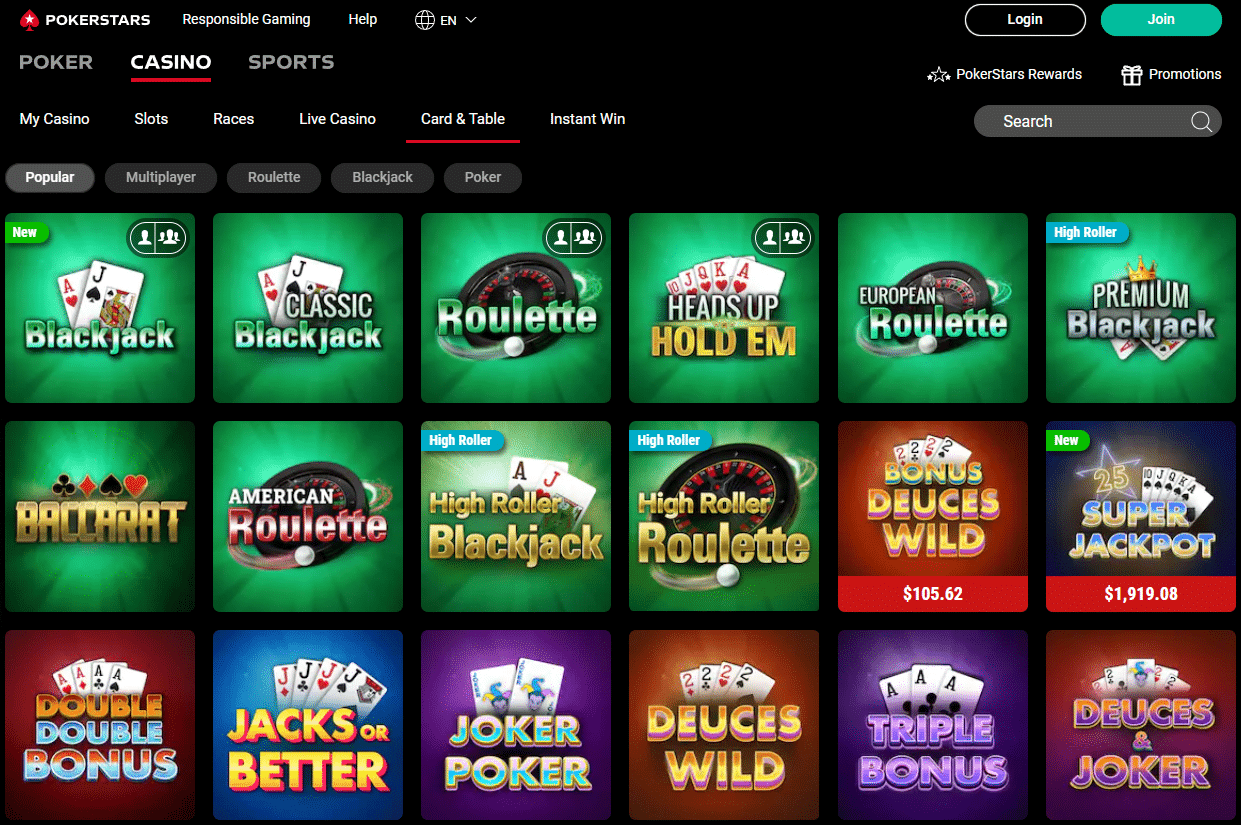

Positives and negatives away from Lower Deposit Web based casinos

- Make each kind of income and its amount in the Identify urban area on the web 16.

- Generally speaking, you are not subject to a punishment in case your 2024 prepayments equivalent at least one hundred% of your 2023 Ny taxation based on a great 12-few days return.

- During the those house, Rob has worked 150 days inside the Singapore and you may thirty day period from the United states.

- If you wish to boost a tenant’s protection put, you will basically end up being bound by a similar laws and regulations one govern almost every other change you may want to build to your tenancy, such as increasing the rent.

Consequently, the amount of money is roofed within the a person’s formula away from internet earnings from mind-employment allocated to the fresh MCTD which is subject to the fresh MCTMT. To suit your age of house, is you to definitely an element of the qualifying retirement and you will annuity income you to your acquired within the several months you’re a resident, yet not more than $20,100000. If you were a part-seasons citizen, through the percentage of all enhancements and you can subtractions you to definitely interact with your new York Condition citizen period on the The brand new York County matter column. Similarly, Nyc County will not income tax particular items of money taxed from the federal government.

While you are his real estate industry works hands free, he produces posts to simply help other people grow and you can create the a house profiles. On occasion, attention attained to your protection deposit must be paid on the tenant, and the property manager may be able to withhold all of the or region of your renter deposit to fund injuries past normal don and you will split. It’s a great Venmo world available—today’s clients are used to using modern percentage answers to publish currency, split costs, and you can only pay their express. Improving protection put transparency will help improve protection deposit ratings. A protection put software also may help slow down the lift for the your group while the owners can get all the details they need within the the fresh software as opposed to calling you which have concerns.

Basic deduction – Find the standard deduction on the California Simple Deduction Chart to have Many people. For those who seemed the container to your Mode 540, line six, use the California Simple Deduction Worksheet to possess Dependents. If someone is claim you while the a depending, you can also allege more of your own simple deduction or the itemized write-offs. To figure your own fundamental deduction, make use of the Ca Simple Deduction Worksheet to own Dependents. For those who have a different target, stick to the country’s behavior for going into the urban area, state, province, county, country, and postal password, as the relevant, regarding the appropriate packets. Printing very first label, center initial, history label, and physical address in the room considering on top of the form.

Particular pension income obtained if you are a great nonresident isn’t taxable to help you Ny County and cannot be included in the brand new York State count column. Development and you may loss from the selling otherwise mood from property aren’t susceptible to allotment. In every times, make use of the government taxation foundation from assets in the calculating investment progress otherwise loss. You might report the fresh leasing earnings inside the Line B along with Line C online eleven, as you derived so it earnings away from Ny County offer while in the their nonresident several months.

Go into the quantity of the newest punishment online 113 and look a correct field on line 113. Over and you can attach the design for those who allege a waiver, use the annualized money fees method, otherwise pay taxation with respect to the plan to own producers and you may fishermen, even though you do not are obligated to pay a penalty. Interest – Focus would be recharged for the any later processing or later payment punishment from the brand-new deadline of the go back to the new date repaid. At the same time, if the other punishment aren’t paid back within 15 months, focus would be charged on the go out of one’s billing notice until the go out from commission. Focus substances each day and the interest are adjusted double a year.

You could discover your brand-new York Condition tax reimburse as much as 14 days sooner than for individuals who submitted by report and you can expected a paper look at. Lender department for many who’lso are 18 ages or older and you can a legal You.S. resident. Financial Mobile software an internet-based banking to cope with your finances on the the brand new wade, along with an elective debit cards. Searching forward to a couple no deposit bonuses while playing during the $5 lowest put online casinos inside 2025.

The question should be replied by the all of the taxpayers, not just taxpayers who engaged in a transaction related to digital possessions. Do not are Societal Defense quantity or people individual or private guidance. Which Yahoo™ interpretation element, considering for the Franchise Tax Panel (FTB) web site, is actually for standard information simply. Large-print variations and you can guidelines – The newest Resident Booklet comes in large print up on consult. Come across “Order Variations and Courses” or “Where you might get Income tax Versions and you may Books.”

You can even obtain the major-rated Wells Fargo Cellular app regarding the Apple App Store otherwise Bing Play and you will create their banking from anywhere. Signing up for a nationwide available borrowing relationship allows you to sense of many of your benefits from borrowing from the bank unions — greatest costs and lower conditions to own fund, for instance — as opposed to restricting you to ultimately just to be able to financial in the a great certain city. Any of these borrowing unions utilize the common part system so you can give greatest across the country inside-people financial accessibility, however the capability to open membership in the those individuals common branches you are going to be restricted.

The security put is a significant advantage for most clients, usually well worth a whole week away from book or higher. The brand new landlord holds the security deposit to help you safe its apartment. Whatever the county laws where you own accommodations property, become familiar with any relevant regional ordinances.